bank financing meaning

A bank loan is when a bank offers to lend money to consumers for a certain time period. Loan - the temporary provision of money usually at interest.

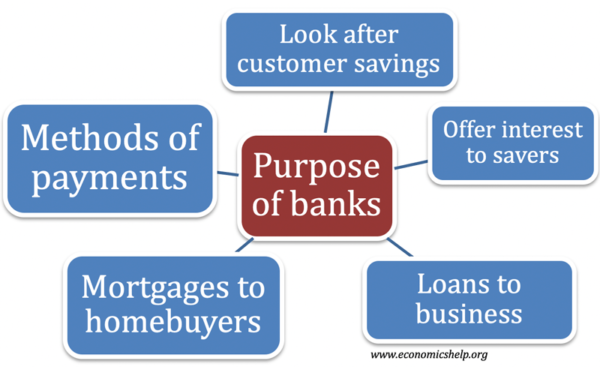

Purpose Of Banks Economics Help

Interbank loan - a loan from one bank to another.

. Features of Bank Loans. 3 5 or 10 years the rate of interest and the timing and amount of repayments. To be repaid with interest on or before a fixed date.

Regardless of which type of bank financing you pursue you should be fully prepared to explain your business show records of its past success and present expected. The process of development of a project consists of 3 stages. A bank loan can be used alongside a hedge or an interest swap for example to ensure that the cost of the loan is suitable for the businesss needs.

A bank loan is an arrangement in which a bank gives you money that you repay with interest. Bank loans have the following characteristics. The advance of a specified sum of money to an individual or business the borrower by a COMMERCIAL BANK SAVINGS BANK.

A bank loan provides medium or long-term finance. Financing means asking any financial institution bank credit union finance company or another person to lend you money that you promise to repay at some point in the future. A bank loan is an extension of credit by a bank to a customer or business.

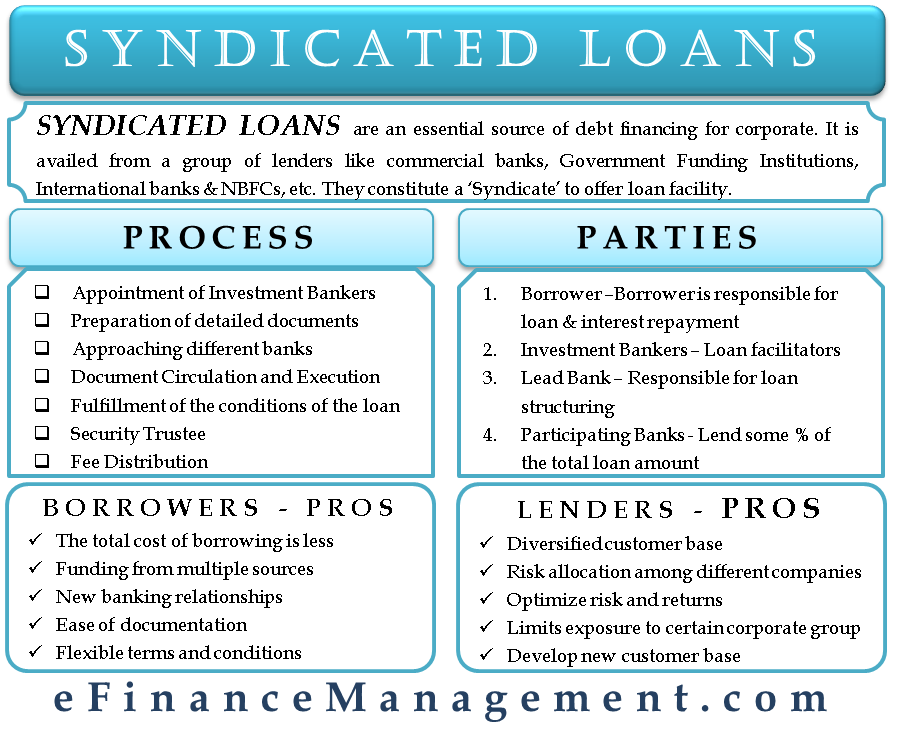

It has to be paid along with interest. A syndicated loan is a facility of finance being offered by a pool of lenders. 1 an institution offering certain financial services such as the safekeeping of money conversion of domestic into and from foreign currencies lending of money at interest and acceptance of bills of exchange.

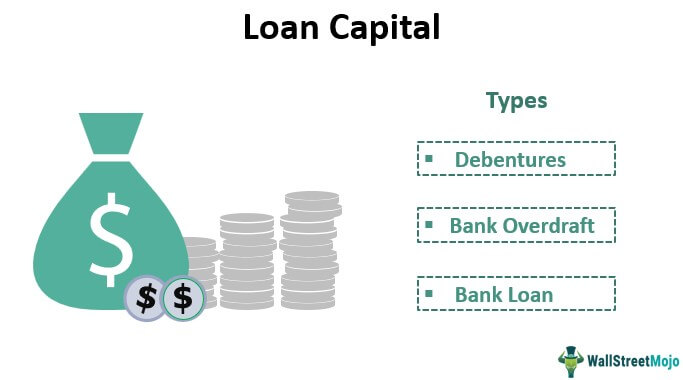

Bank loan - a loan made by a bank. A bank loan is the most common form of loan capital for a business. There are different types of loans available including mortgage and offset facilities.

Bank loans are a common form of finance like trade credit and overdraft facilities. In other words. Be it a long-term infrastructure public services or industrial project sourcing funds to implement and successfully run an.

Maturity refers to the length of time between origination of a financial claim loan bond or other financial instrument and. Banks may also provide financial services such as wealth management currency exchange and safe deposit boxes. He is unable to secure a bank loan for his business venture.

Long-term finance can be defined as any financial instrument with maturity exceeding one year such as bank loans bonds leasing and other forms of debt finance and public and private equity instruments. Bank loans are the easiest source of availing finance. A sum of money borrowed by a customer or business from a bank often for a specific purpose such as buying a car.

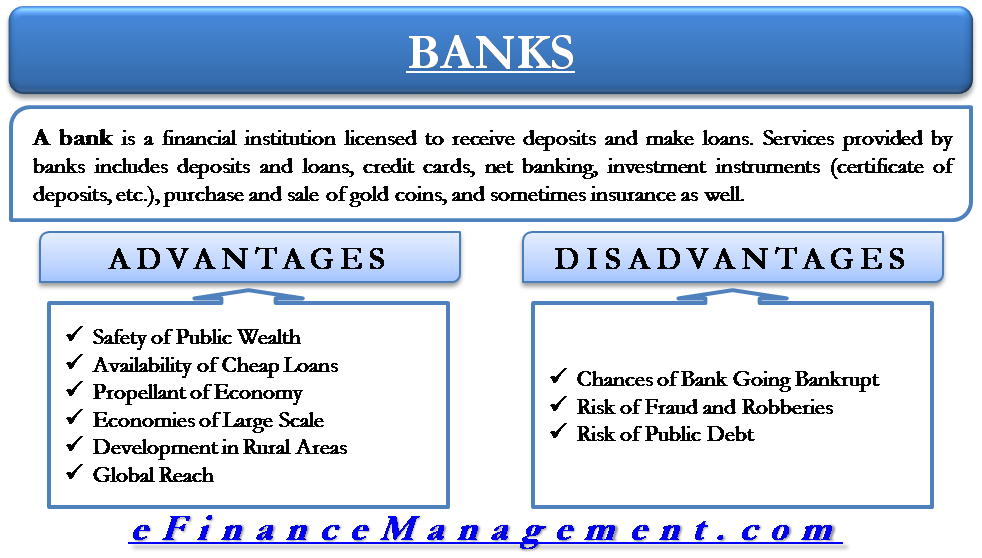

Copyright HarperCollins Publishers. A bank is a financial institution licensed to receive deposits and make loans. A loan that is made by a bank.

A deposit-taking institution which is licensed by the monetary authorities of a country the BANK OF ENGLAND in the UK to act as a repository for money deposited by persons companies and institutions and which undertakes to repay such deposits either immediately on demand or subject to due notice being given. 2 the building used by such an institution. An establishment for the custody loan exchange or issue of money for the extension of credit and for facilitating the transmission of funds paychecks automatically deposited into the bank went to the bank to make a withdrawal open a bank account.

Loans are distinct from revolving credit accounts such as credit cards or home equity lines of credit which allow you to continually borrow and repay up to a certain amount. The bank sets the fixed period over which the loan is provided eg. A bank loan to be repaid over 5 years.

A bank loan is a form of CREDIT which is extended for a specified period of time usually on fixed-interest terms related to the base rate of interest with the principal being repaid either on a regular instalment basis or in full on the. It is a short-term source of finance. The banks use funds to provide loans to the rest of the banks customers that have funding shortages for a fee known as an interest payment.

Business loan commercial loan - a bank loan granted for the use of a business. Bank loan definition an amount of money loaned at interest by a bank to a borrower usually on collateral security for a certain period of time. The bank will usually require that the business provides some security collateral for the loan.

Bank financing is the most traditional financing method and is usually the first thought people have when they consider funding their business. Definition of bank loan. This is a loan which uses an asset as collateral.

The large borrower can be a corporation a joint venture for a particular project or a sovereign government. Banks can finance business operations in a number of ways. Loan Financing means any money borrowed from A a bank financial institution hedge fund pension fund or insurance company or B any other entity having as its principal business the lending of money andor investing in loans in each case other than public or quasi-public entities or international organisations with a public or quasi-public character.

The services obtained from investment banks include helping firms to raise capital in the stock markets by undertaking to value the company stock provide underwriting services conducting road shows to stimulate. As a condition of the bank loan the borrower will need to pay a certain amount of interest per month or per year. These pools of lenders are called syndicates who agree as a group to provide significant loans for single borrowers.

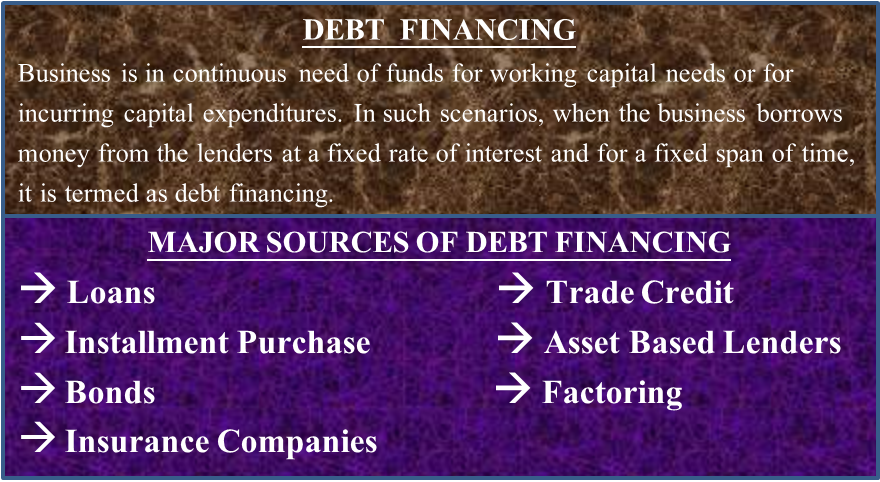

Sources Of Debt Financing Type Loan Trade Credit Factoring Bond Etc

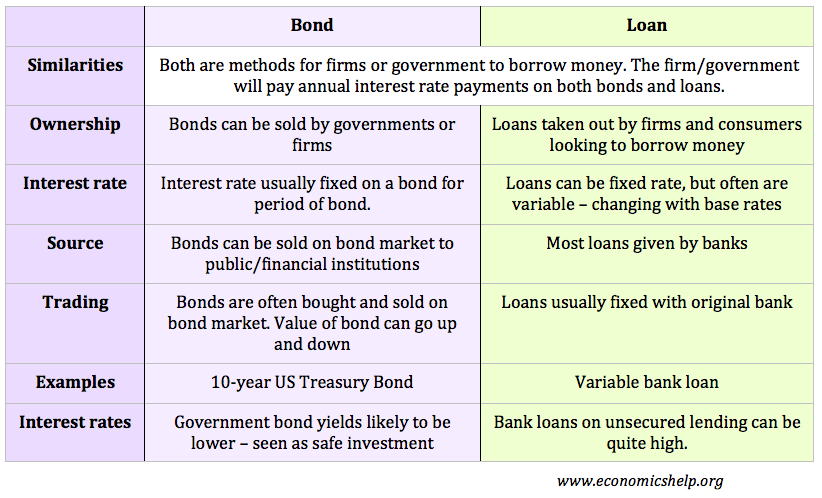

Difference Between Bonds And Loans Economics Help

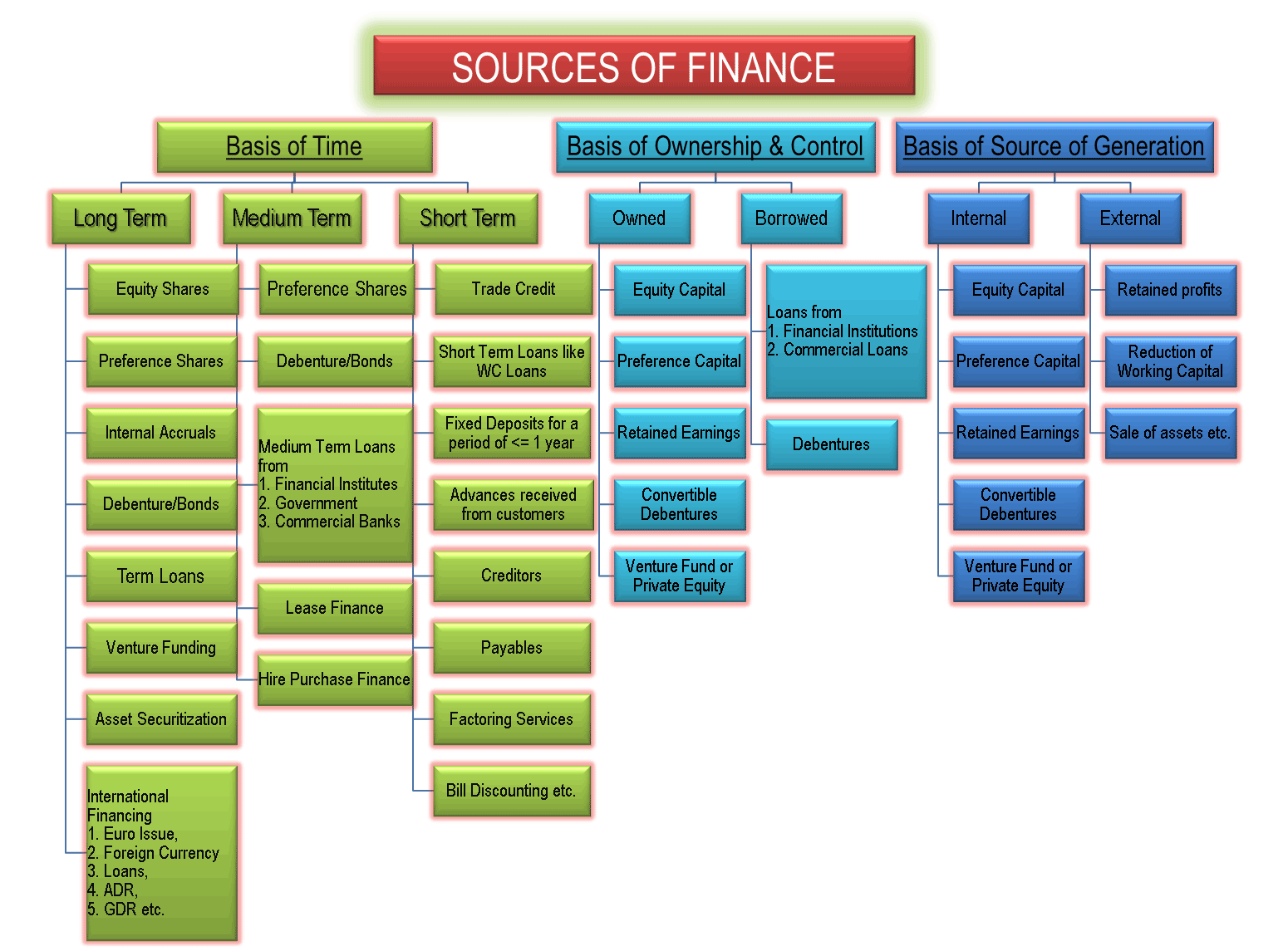

Sources Of Finance Owned Borrowed Long Short Term Internal External

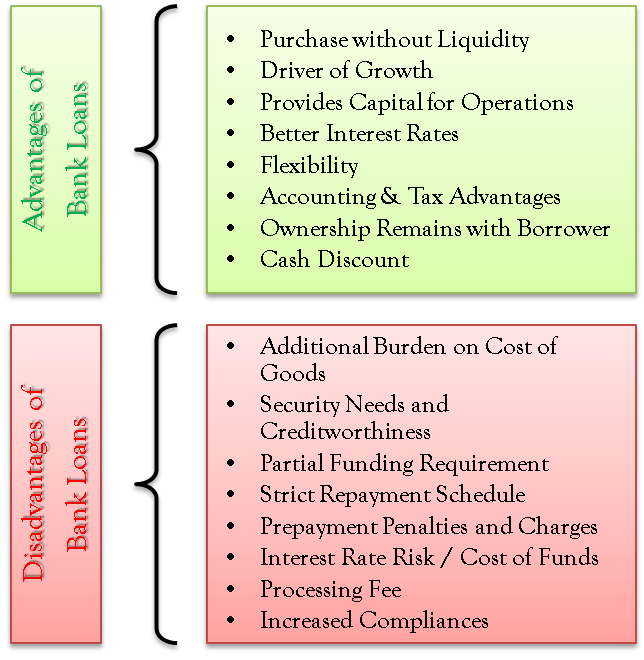

Advantages And Disadvantages Of Bank Loans Efinancemanagement

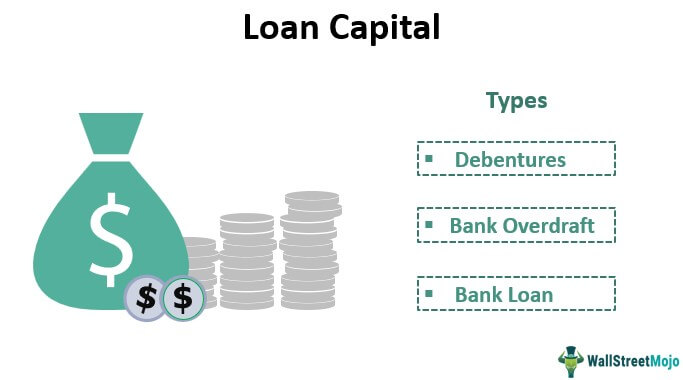

Loan Capital Definition Types Advantages Disadvantages

Advantages And Disadvantages Of Banks Efinancemanagement

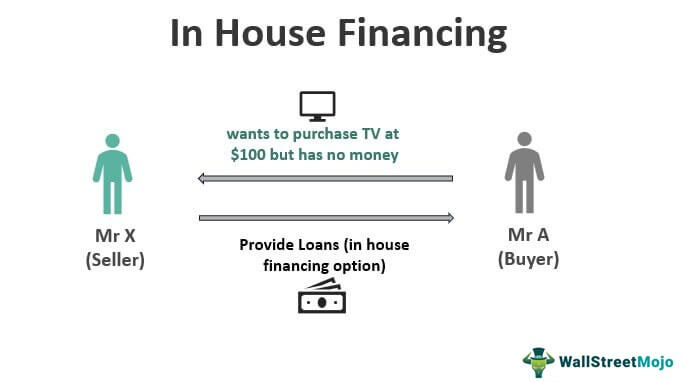

In House Financing Meaning Example How Does It Work

Syndicated Loan Meaning Parties Involved Process Benefits Etc

Komentar

Posting Komentar